√100以上 yield to maturity calculator zero coupon bond 202082-Yield to maturity calculator coupon bond

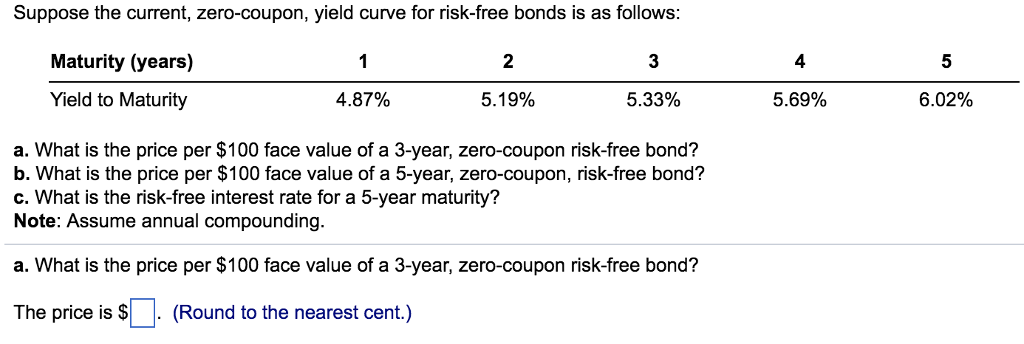

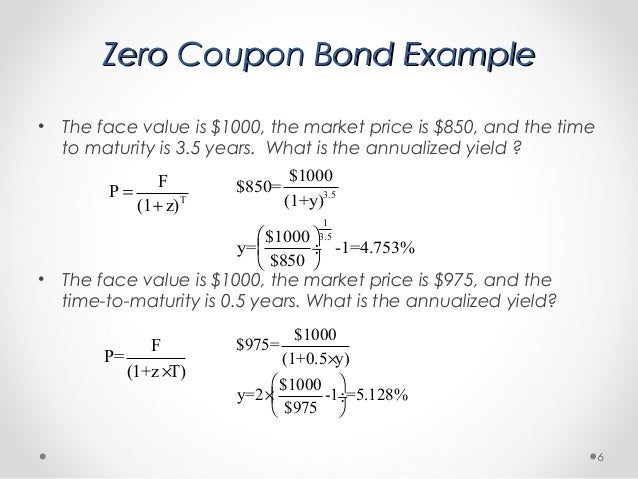

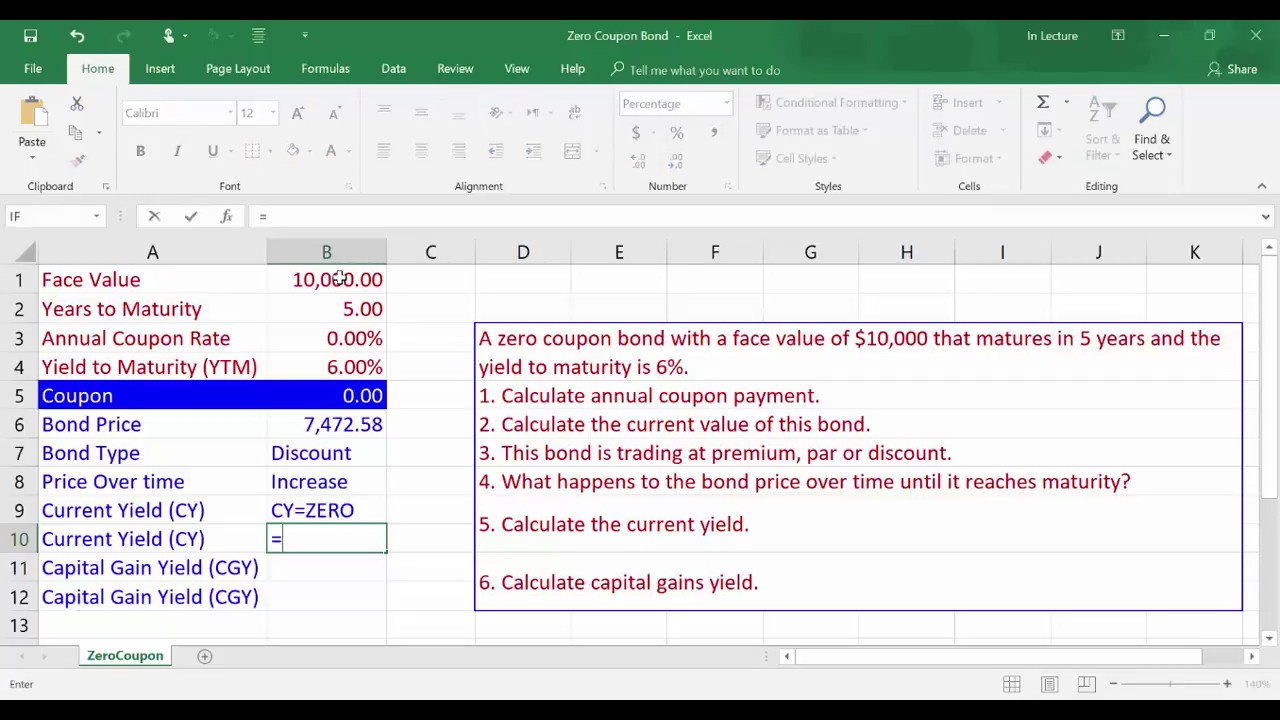

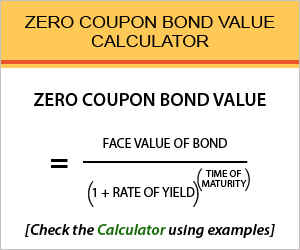

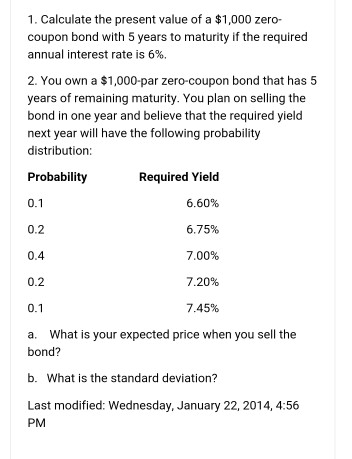

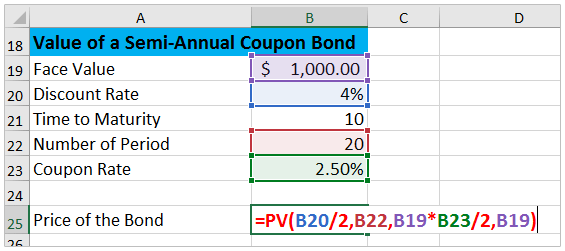

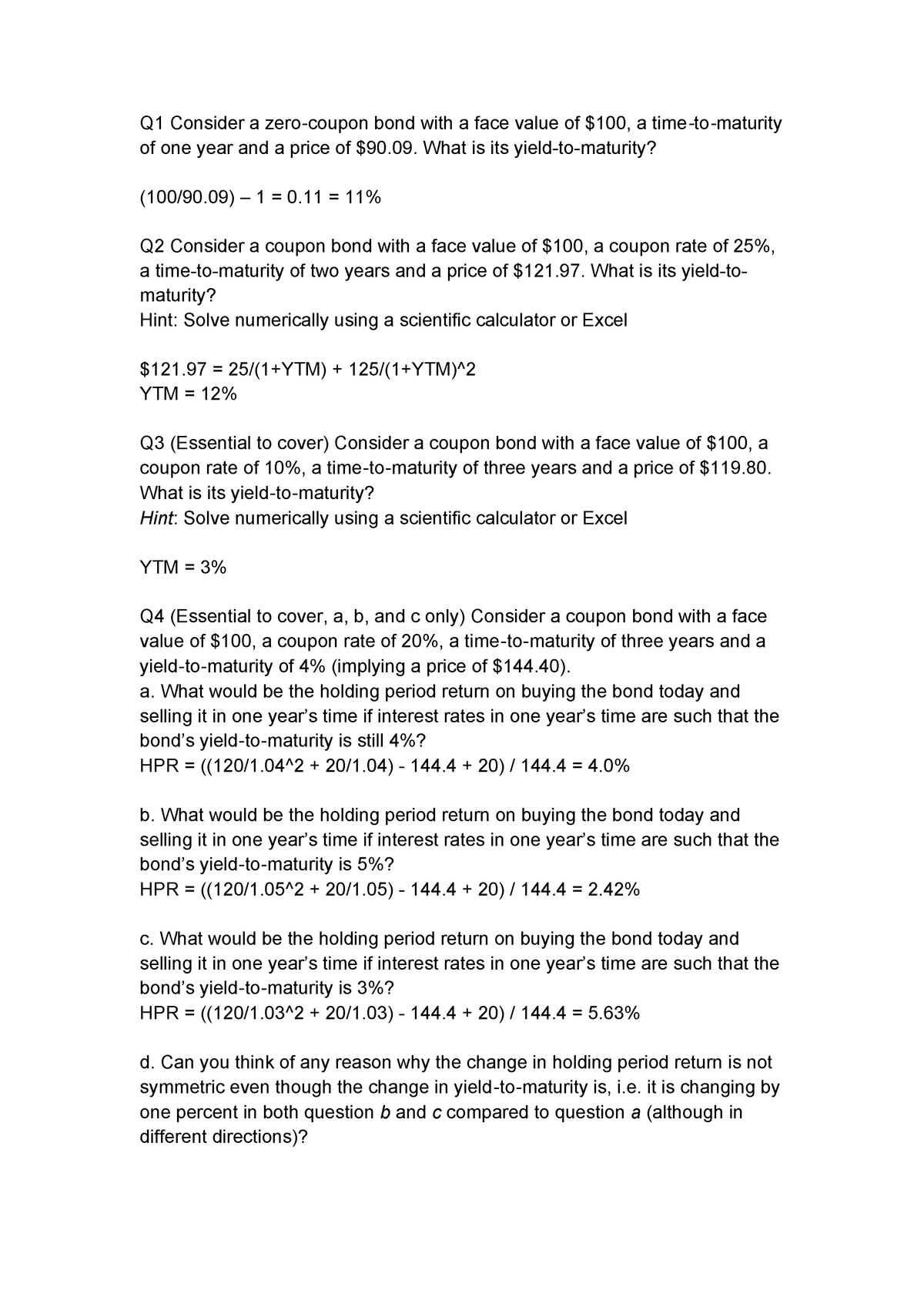

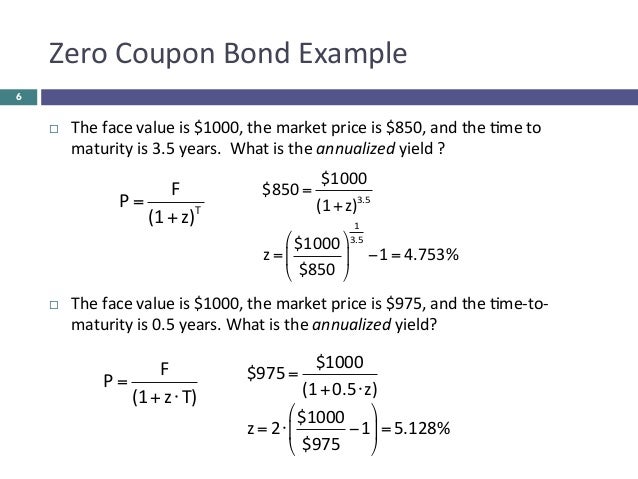

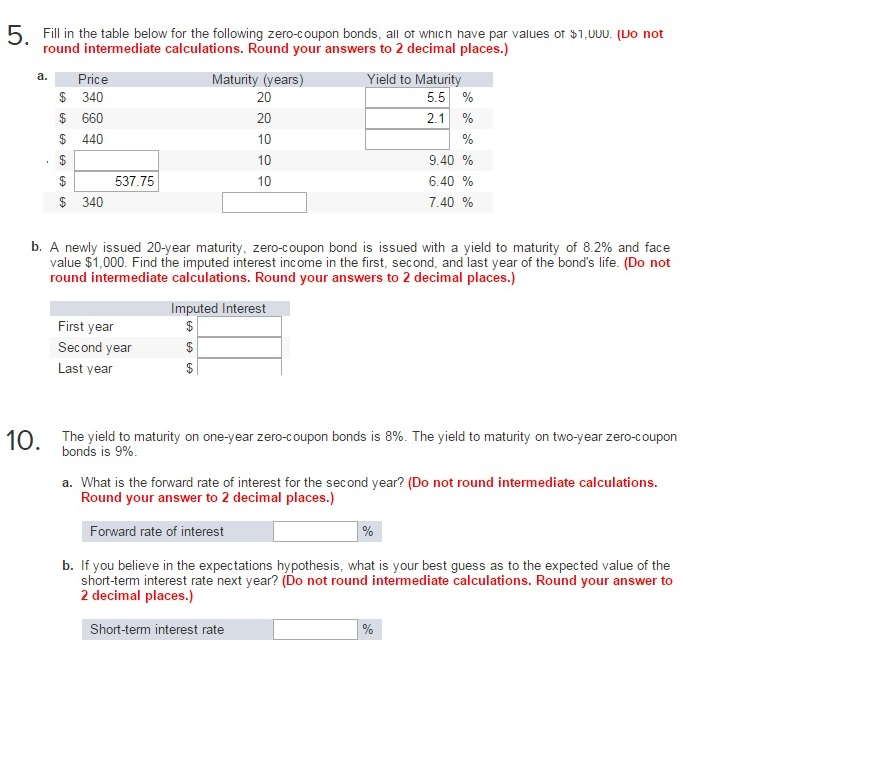

YTM Calculator The YTM calculator has two parts, one is to calculate the current bond yield, and the other is to calculate yield to maturity Bond Yield Formula Following is the bond yield formula on how to calculate bond yield Current Bond Yield (CBY) = F*C/P, where C = Bond Coupon Rate F = Bond Par Value P = Current Bond Price(iv) four years (Do not round intermediate calculations Round your answers to two decimal places)Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturity

Coupon Two Coupon Yield

Yield to maturity calculator coupon bond

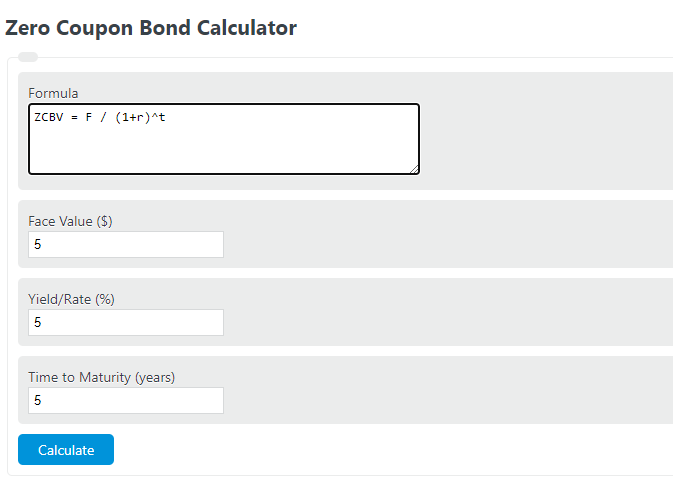

Yield to maturity calculator coupon bond-Bond Yield to Maturity Calculator Use the Bond Yield to Maturity Calculator to compute the current yield and yield to maturity for a bond with a specified face (par) value, current value, coupon rate and years to maturity The calculator assumes one coupon payment per year at the end of the yearThe calculator, which assumes semiannual compounding, uses the following formula to compute the value of a zerocoupon bond Value = Face Value / (1 Yield / 2) ** Years to Maturity * 2 Related Calculators Bond Convexity Calculator Bond Duration Calculator Macaulay Duration, Modified Macaulay Duration and Convexity Bond Present Value

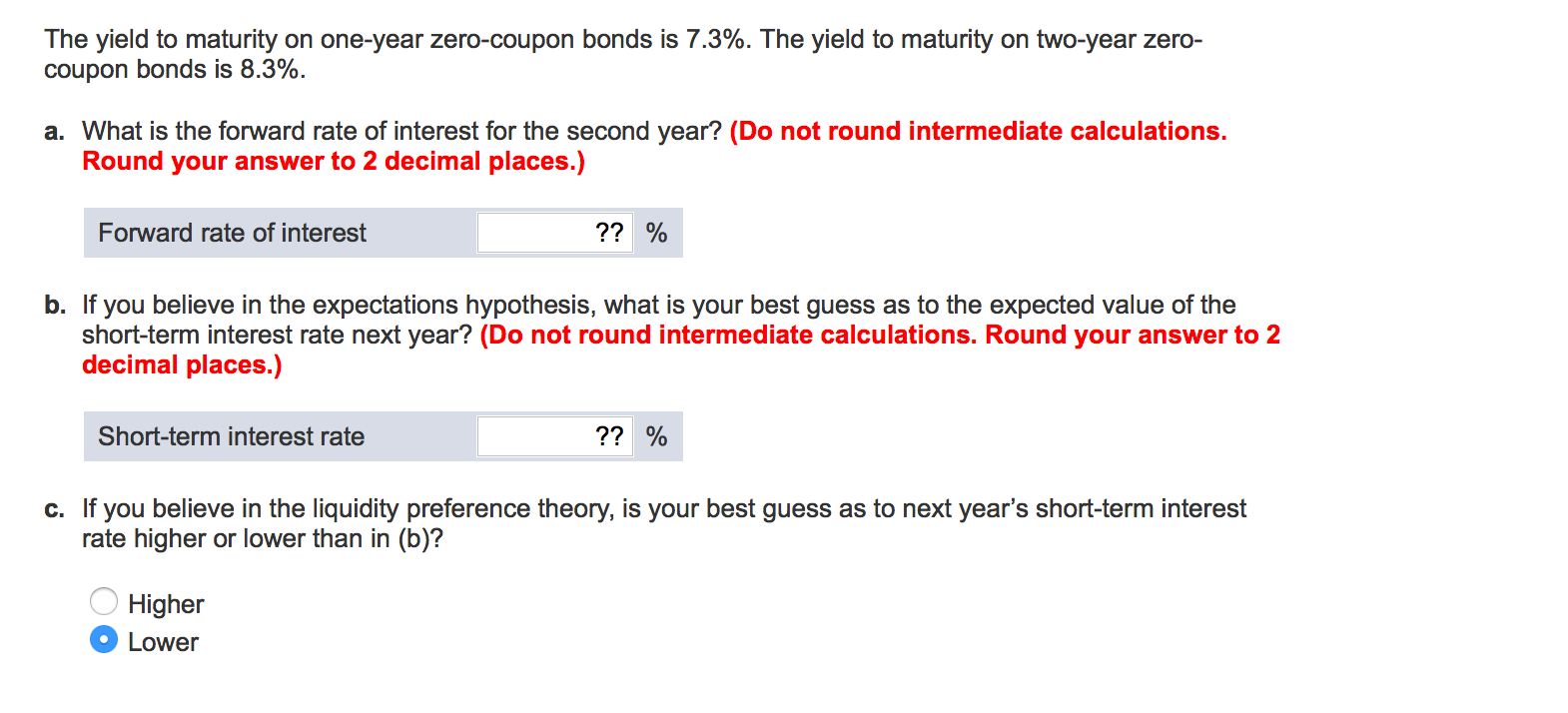

The Yield To Maturity On One Year Zero Coupon Bonds Is 8 2 The Yield To Maturity On Two Year Zero Coupon Bonds Is 9 2 A What Is The Forward Rate Of Interest For The Second Year

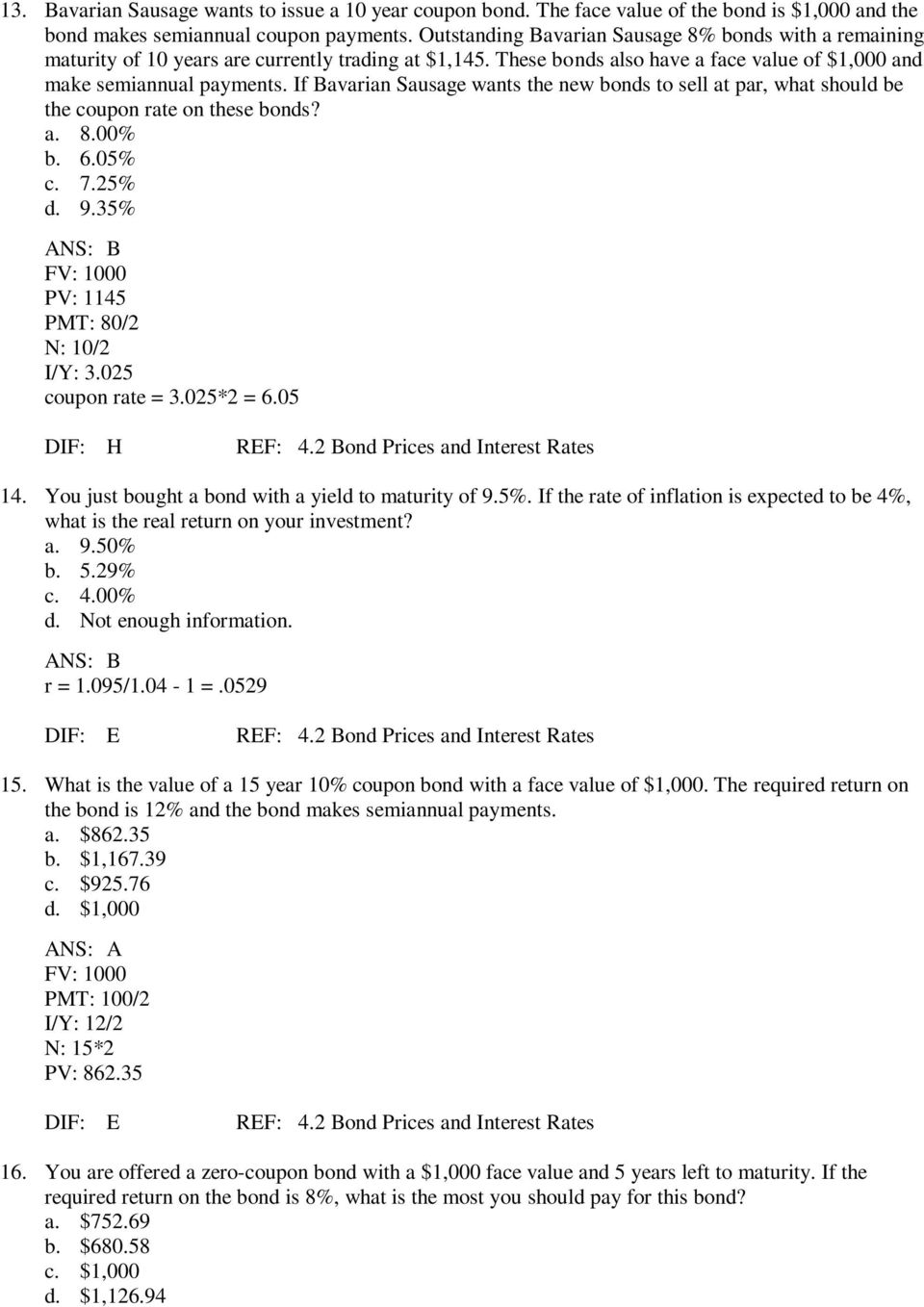

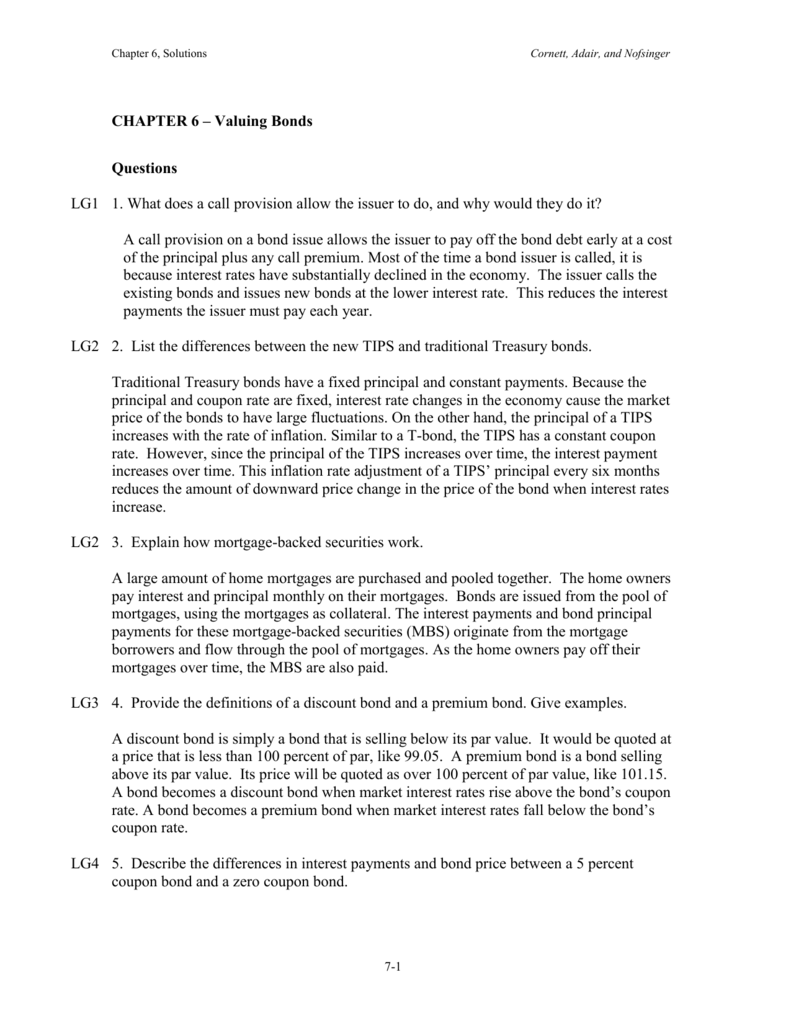

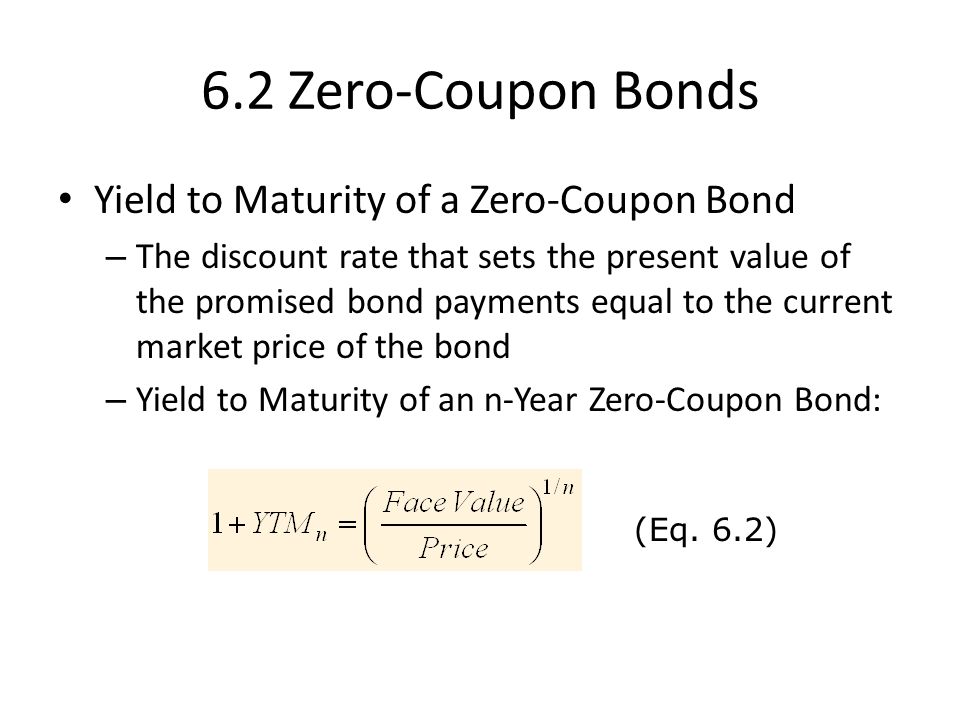

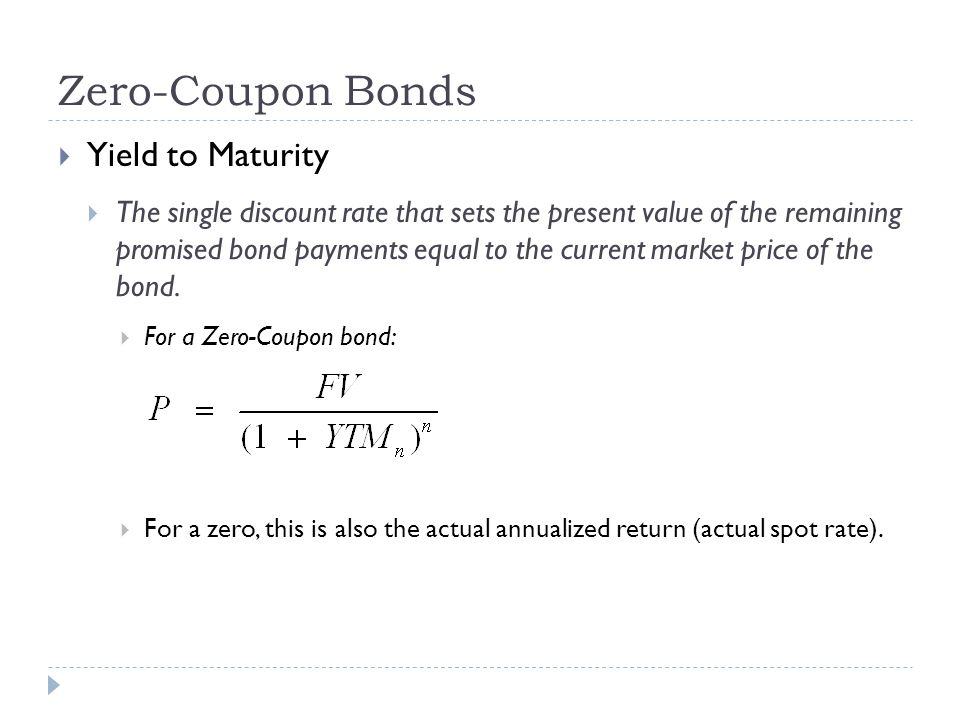

Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond based on compoundingZero coupon bond yield is calculated by using the present value equation and solving it for the discount rate The resulting rate is the yield It is both the discount rate that is revealed by the market situation and the return rate that investors expect from the bond The zero coupon bond yield helps investors decide whether to invest in bondsIt is not a good measure of return for those looking for capital gains Furthermore, the current yield is a useless statistic for zerocoupon bonds The Yield to Maturity Unlike the current yield, the yield to maturity (YTM) measures both current income and expected capital gains or losses

(Do Not Round Intermediate CalculationsAs per the CouponMound's tracking system, it offers 17 search results of Zero Coupon Bond Yield To Maturity Calculator Coupons for Zero Coupon Bond Yield To Maturity Calculator with verified labels work for most purchasesThe difference between the current price of the bond, ie, $, and its Face Value, ie, $1000, is the amount of compound interest that will be earned over the 10year life of the Bond Thus Cube Bank will pay $ and will receive $1000 at the end of 10 years, ie, on the maturity of the Zero Coupon Bond, thereby earning an effective yield of 8%

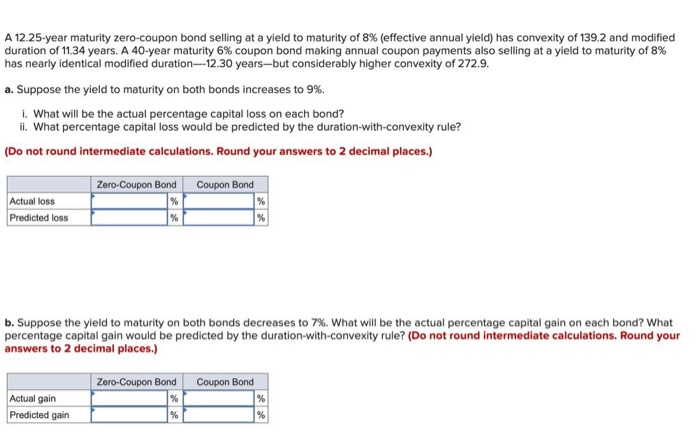

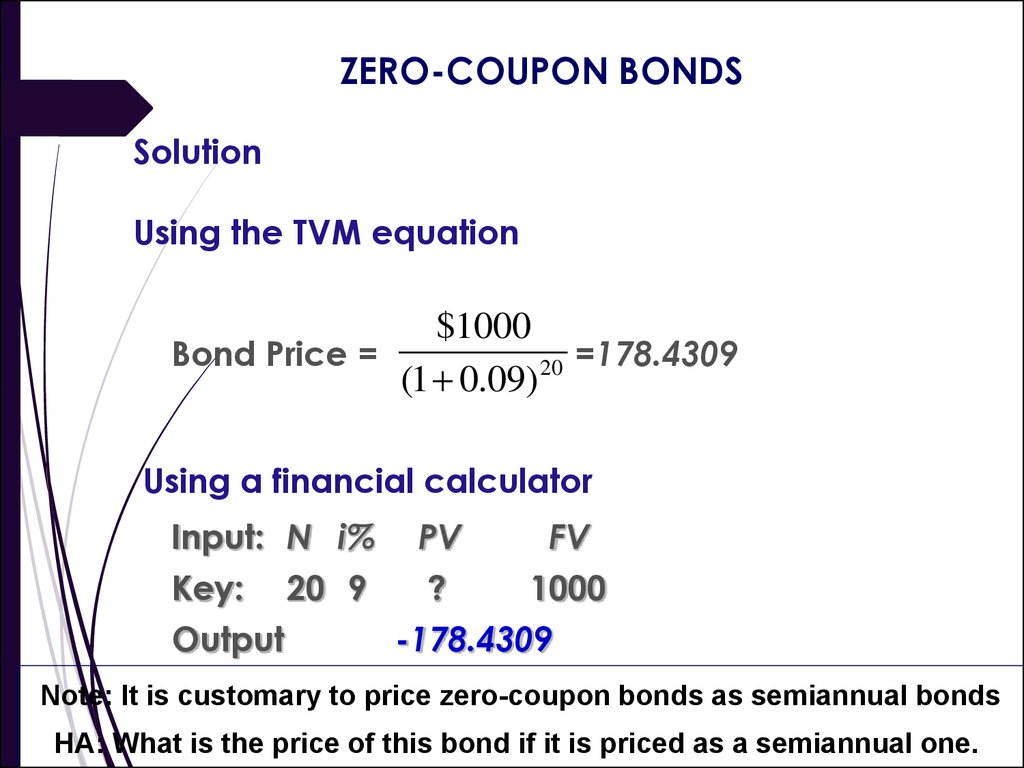

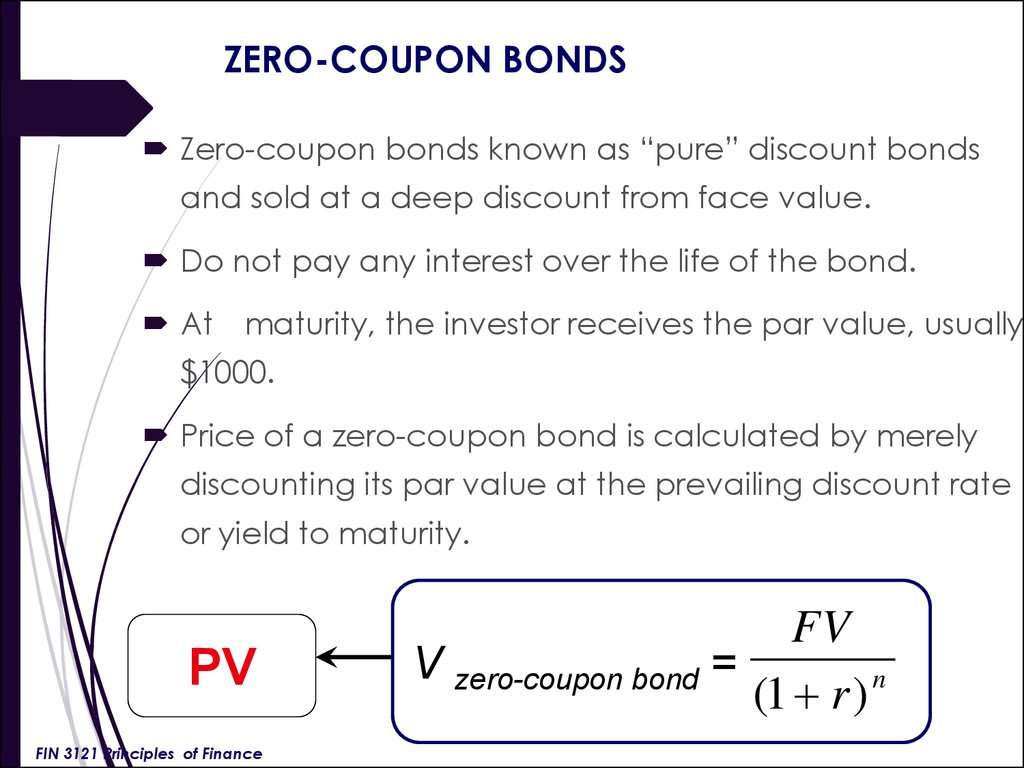

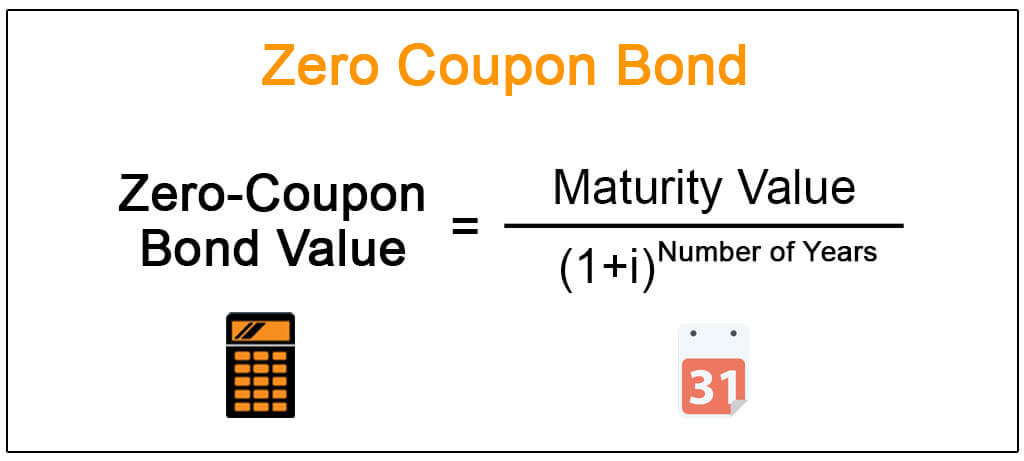

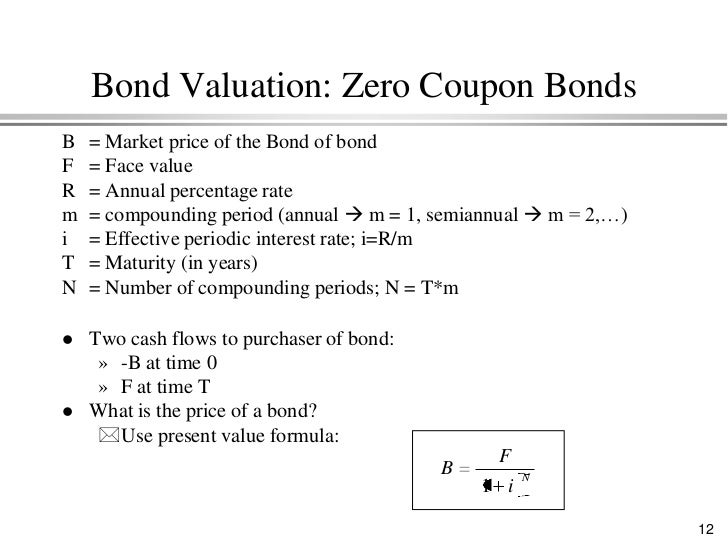

A zerocoupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value P = m (1 r) n Where, P = ZeroCoupon Bond Price M = Face value at maturity or face value of bond r = annual yield or rate n = years until maturityMonths to Maturity The numbers of months until bond maturity (not thisZerocoupon bonds differ from traditional bonds in that they don't make periodic interest payments That doesn't mean zerocoupon bonds are a bad investment To calculate how much you should pay for a zerocoupon bond, you need to know the rate of return that you're expecting to return on the bond

Zero Coupon Interest Calculator

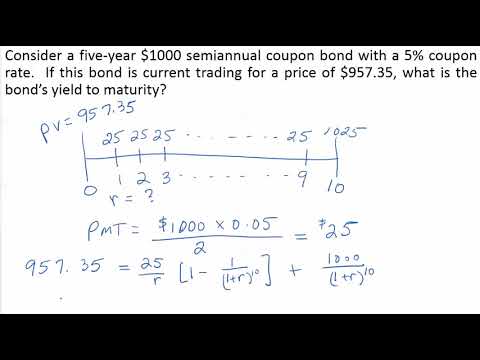

21 Cfa Level I Exam Cfa Study Preparation

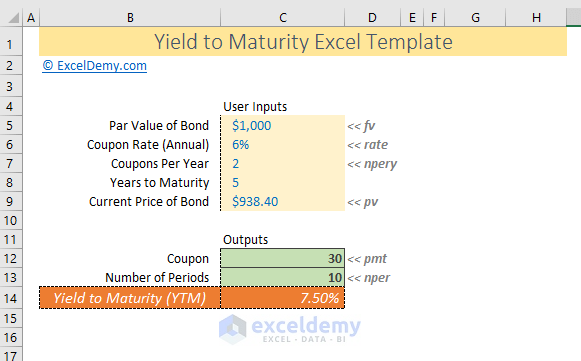

Calculating the Yieldtomaturity of a Bond using Spot Rates Continuing on the same example, this 3year bond is priced at a premium above par value, so its yieldtomaturity must be less than 6% We can now use the financial calculator to find the yieldtomaturity using the following inputs N = 3;Nper = Total number of periods of the bond maturity Years to maturity of the bond is 5 years But coupons per year is 2 So, nper is 5 x 2 = 10 Pmt = The payment made in every period It cannot change over the life of the bond The coupon rate is 6% But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%How to Calculate Yield to Maturity Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond's future coupon payments In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturity

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Can Zero Coupon Bonds Go Down In Price Personal Finance Money Stack Exchange

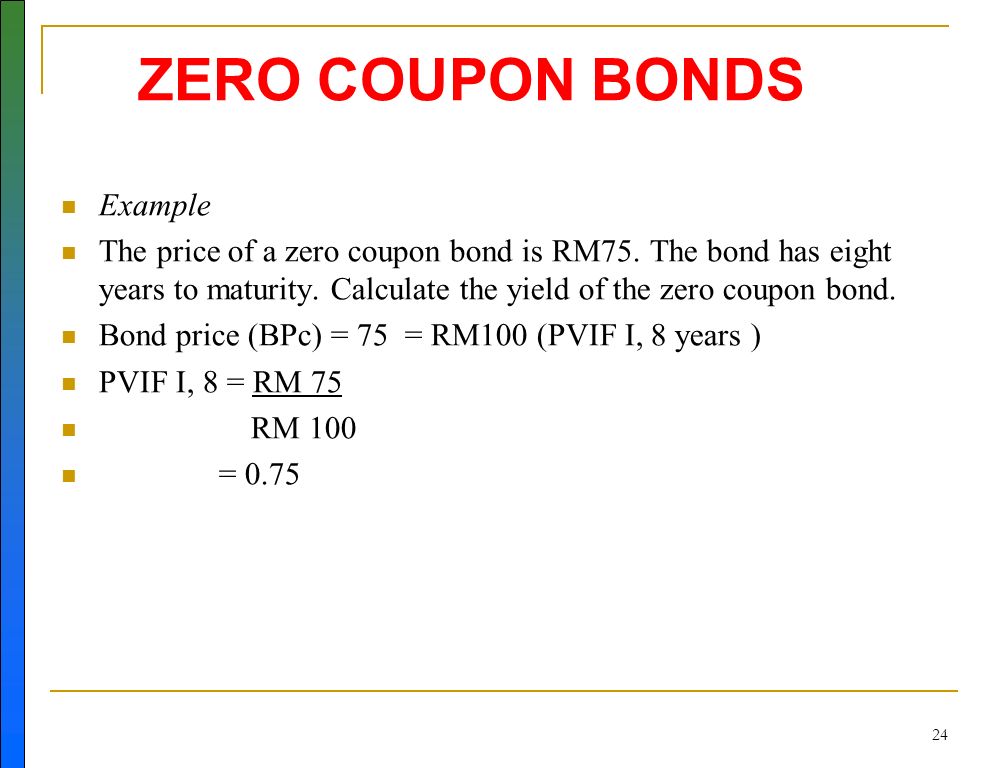

Calculating Yield to Maturity on a Zerocoupon Bond YTM = (M/P) 1/n 1 variable definitions YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value;Zero Coupon Bond Yield Formula (with Calculator) CODES (2 days ago) A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000As per the CouponMound's tracking system, it offers 17 search results of Zero Coupon Bond Yield To Maturity Calculator Coupons for Zero Coupon Bond Yield To Maturity Calculator with verified labels work for most purchases

Calculate The Ytm Of A Coupon Bond Youtube

Yields To Maturity On Zero Coupon Ronds Bond Math

Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond based on compounding(1 months ago) Zero Coupon Bond Yield Formula (with Calculator) CODES (3 days ago) A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000YTM Calculator The YTM calculator has two parts, one is to calculate the current bond yield, and the other is to calculate yield to maturity Bond Yield Formula Following is the bond yield formula on how to calculate bond yield Current Bond Yield (CBY) = F*C/P, where C = Bond Coupon Rate F = Bond Par Value P = Current Bond Price

Zero Coupon Bond Yield Formula With Calculator

Finding Ytm Of A Zero Coupon Bond 6 2 1 Youtube

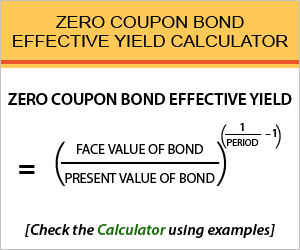

A zero coupon bond, sometimes referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments and instead pays one lump sum at maturity The amount paid at maturity is called the face valueYield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturityThe zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000

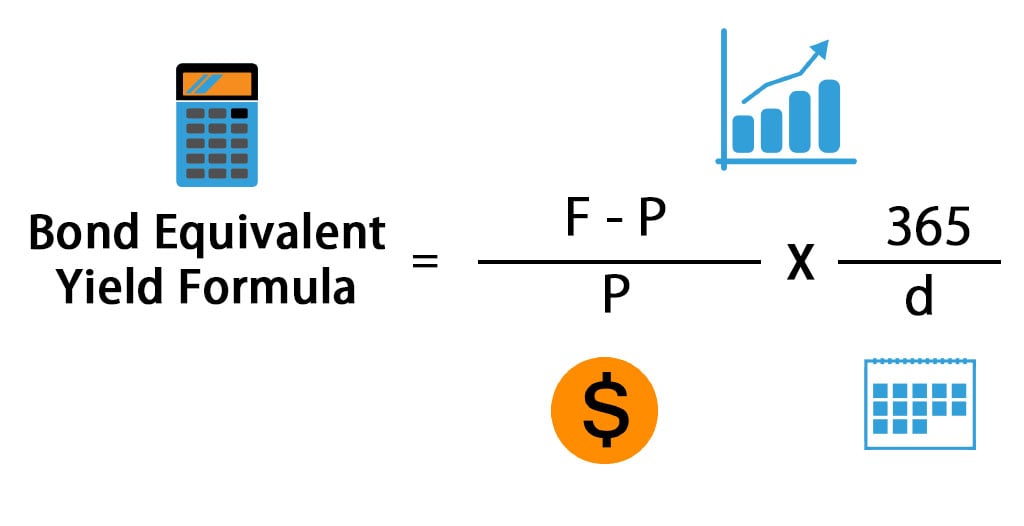

Bond Equivalent Yield Formula Calculator Excel Template

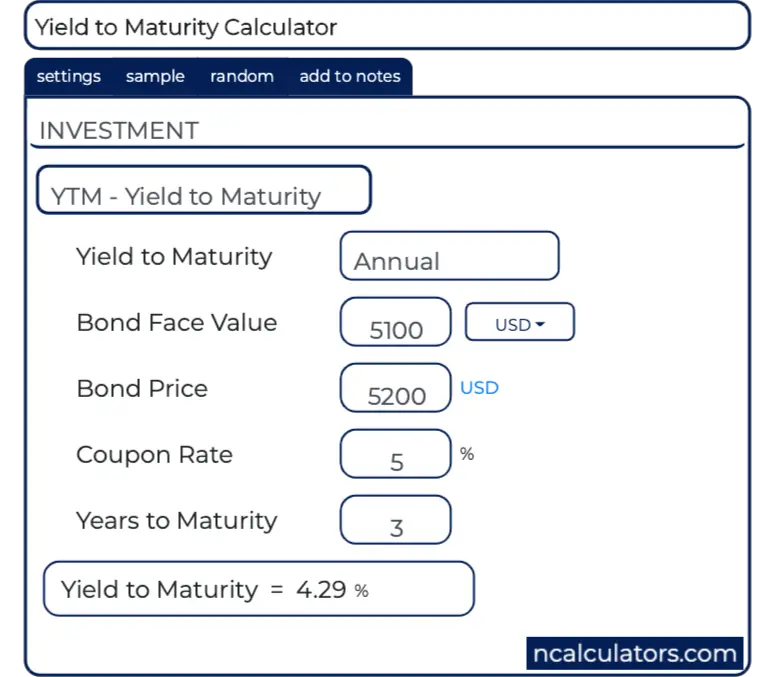

Rwjchapter7problemsolutions

The zerocoupon bond value calculation formula is as follows Zero coupon bond value = F / (1 r) t Where F = face value of bond r = rate or yield t = time to maturityZero Coupon Bond Yield Calculator A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond This calculator can be used to calculate the effective annual yield or yield to maturity (YTM) of investment in such bond when the bond is held till maturityBond Price vs Yield estimate for the current bond Zero Coupon Bonds In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity However, it does have a modified (dollar) duration and convexity Zero Coupon Bond Convexity Formula The formula for convexity of a zero coupon bond is

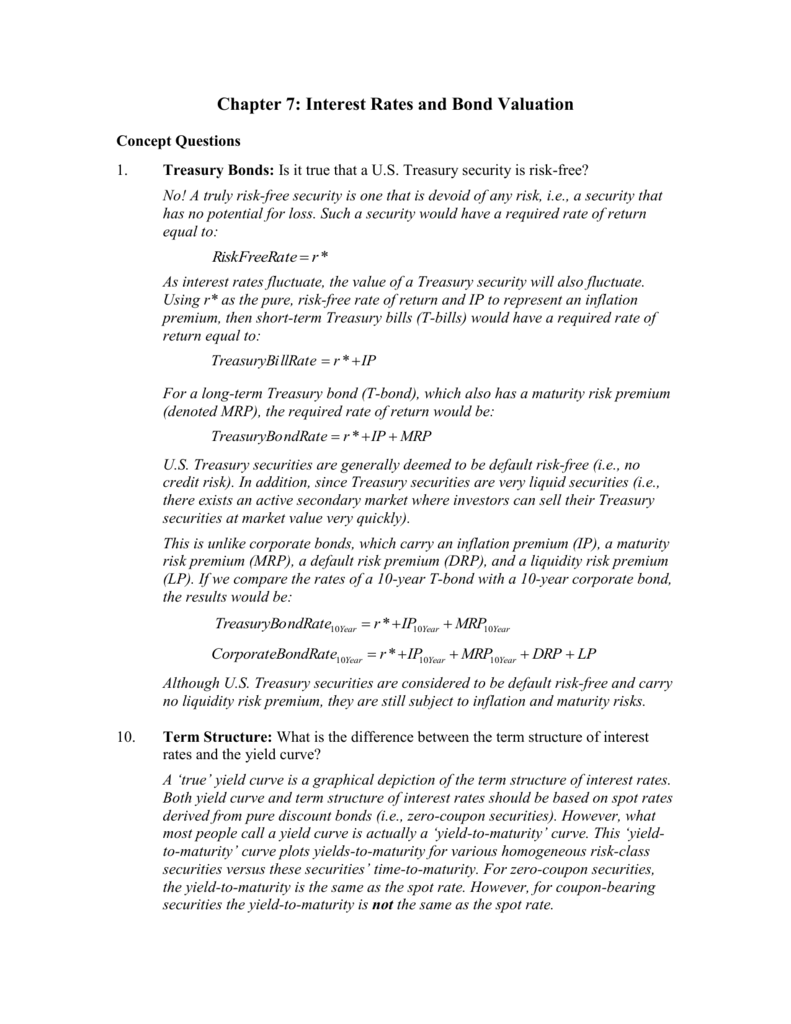

Solved A 12 25 Year Maturity Zero Coupon Bond Selling At Chegg Com

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

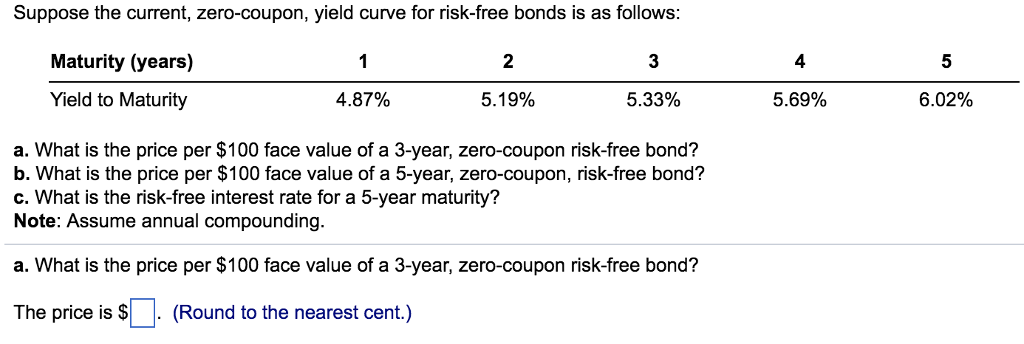

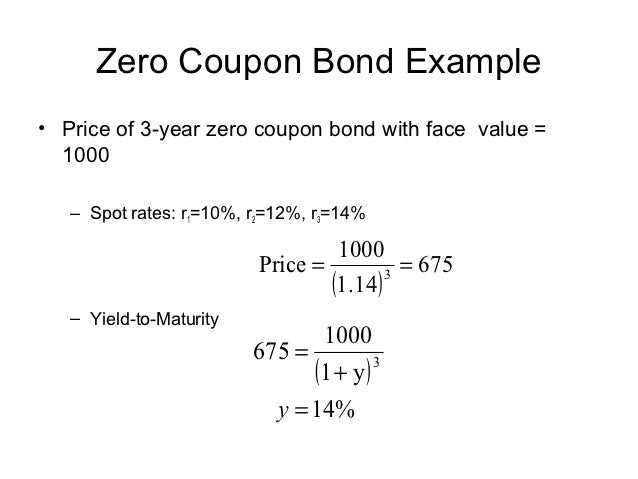

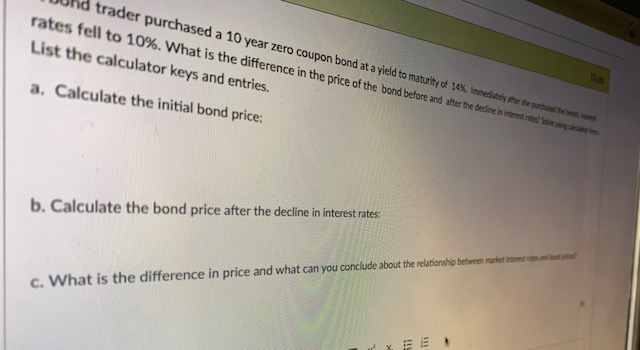

Zero Coupon Yield To Maturity Calculator, 0221 CODES (3 days ago) Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years Divide the $1,000 by $500 gives us 2 Raise 2 to the 1/30th power and you getThe following is a list of prices for zerocoupon bonds of various maturities a Calculate the yield to maturity for a bond with a maturity of (i) one year;The Bond Yield to Maturity Calculator is used to calculate the bond yield to maturity Bond Yield to Maturity Definition The bond yield to maturity (abbreviated as Bond YTM) is the internal rate of return earned by an investor who buys the bond today at the market price, assuming that the bond will be held until maturity and that all coupon

Bond Yield To Maturity Ytm Calculator

Yield To Maturity Ytm Calculator

Zero Coupon Yield To Maturity Calculator, 0221 CODES (2 days ago) Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years Divide the $1,000 by $500 gives us 2 Raise 2 to the 1/30th power and you getThe coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond for the bond is 15% and the bond will reach maturity in 7 years The formula for determining approximate YTM would look like below The approximated YTM on the bond is 1853% Importance of Yield to MaturityBond Yield to Maturity Calculator Use the Bond Yield to Maturity Calculator to compute the current yield and yield to maturity for a bond with a specified face (par) value, current value, coupon rate and years to maturity The calculator assumes one coupon payment per year at the end of the year

How To Calculate The Price Of A Zero Coupon Bond

Bond Yield Calculator

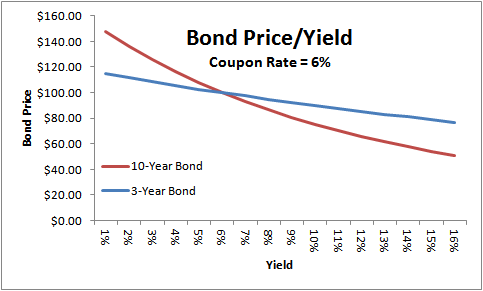

CY = 875%, The Current Yield is 875% The calculator uses the following formula to calculate the yield to maturity P = C×(1 r)1 C×(1 r)2 C×(1 r)Y B×(1 r)Y Where P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond,The following is a list of prices for zerocoupon bonds of various maturities a Calculate the yield to maturity for a bond with a maturity of (i) one year;A zerocoupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve With a normal yield curve, longterm bonds have higher

A 12 25 Year Maturity Zero Coupon Bond Selling At A Yield To Maturity Of 8 Effective Annual Yield Homeworklib

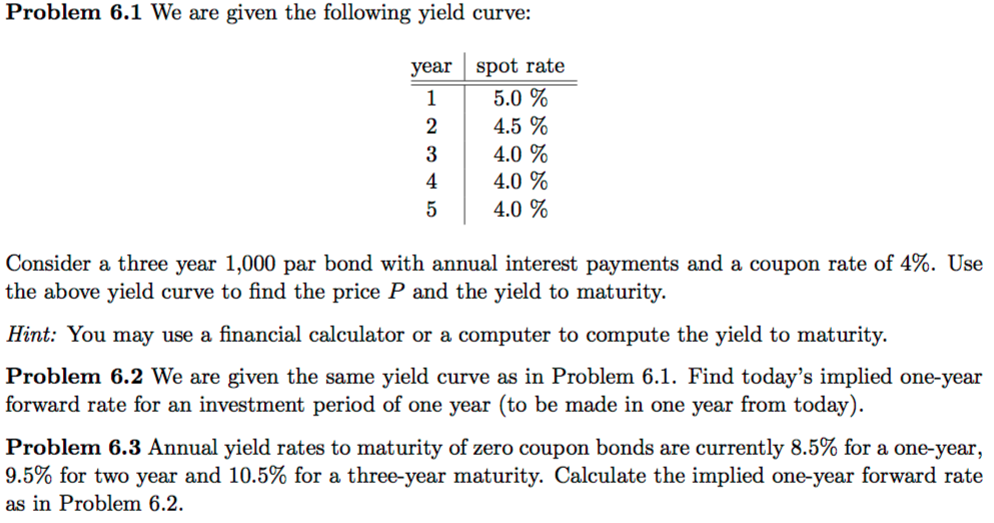

Solved Problem 6 1 We Are Given The Following Yield Curve Chegg Com

To calculate a bond's yield to maturity, enter the face value (also known as "par value"), coupon rate, number of years to maturity, frequency of payments, and the current price of the bond How to Calculate Yield to Maturity For example, you buy a bond with a $1,000 face value and an 8% coupon for $900The price of the bond is $1,, and the face value of the bond is $1,000 The coupon rate is 75% on the bond Based on this information, you are required to calculate the approximate yield to maturity on the bond Solution Use the belowgiven data for calculation of yield to maturity(Since this is a cash outflow)

Ytm Formula Excel

The Yield To Maturity On One Year Zero Coupon Bonds Is 8 2 The Yield To Maturity On Two Year Zero Coupon Bonds Is 9 2 A What Is The Forward Rate Of Interest For The Second Year

How to detect whether Zero Coupon Bond Yield To Maturity Calculator results are verified or not?On this page is a bond yield to maturity calculator, to automatically calculate the internal rate of return (IRR) earned on a certain bond This calculator automatically assumes an investor holds to maturity, reinvests coupons, and all payments and coupons will be paid on time The page also includes the approximate yield to maturity formula, and includes a discussion on how to find – or approach – the exact yield to maturityCalculating the Macauley Duration in Excel Assume you hold a twoyear zerocoupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel

The Problem Of Estimating The Volatility Of Zero Coupon Bond Interest Rate

Coupons Deals

(iv) four years (Do not round intermediate calculations Round your answers to two decimal places)It is not a good measure of return for those looking for capital gains Furthermore, the current yield is a useless statistic for zerocoupon bonds The Yield to Maturity Unlike the current yield, the yield to maturity (YTM) measures both current income and expected capital gains or lossesUnlike Coupon Bonds, a zero coupon bond is a bond that makes no periodic interest/coupon payments while it grows to maturityIt is for this reason that zero coupon bonds are sold at a deep discount from their face value The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date

Q Tbn And9gcsp25zjynanfjklb7g 0opdrwusuwkhwdwzqpddk9o Usqp Cau

Zero Coupon Bond Definition Formula Examples Calculations

The formula for calculating the yield to maturity on a zerocoupon bond is Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Consider a $1,000 zerocoupon bond that hasCalculate either a bond's price or its yieldtomaturity plus over a dozen other attributes with this fullfeatured bond calculator If you are considering investing in a bond, and the quoted price is $9350, enter a "0" for yieldtomaturity Also, enter the settlement date, maturity date, and coupon rate to calculate an accurate yieldLet's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years

Duration And Convexity For Us Treasuries Financetrainingcourse Com

Valuing Bonds Lecture 6 Online Presentation

How to detect whether Zero Coupon Bond Yield To Maturity Calculator results are verified or not?N = years until maturity;Zero Coupon Yield To Maturity Calculator, 0221 CODES (3 days ago) Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years Divide the $1,000 by $500 gives us 2 Raise 2 to the 1/30th power and you get

Zero Coupon Bond Yield Calculator Ytm Of A Discount Bond

Zero Coupon Bond Valuation Using Excel Youtube

Enter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield The tool will also compute yield to maturity, but see the YTM calculator for a better explanation plus the yield to maturity formula Bond Yield CalculatorZero Coupon Bond Calculator Inputs Bond Face Value/Par Value ($) The face or par value of the bond – essentially, the value of the bond on its maturity date Annual Interest Rate (%) The interest rate paid on the zero coupon bond Years to Maturity The numbers of years until the zero coupon bond's maturity date;Question Consider The Following $1,000 Par Value Zerocoupon Bonds Bond Years Until Maturity Yield To Maturity A 1 875 % B 2 975 C 3 1025 D 4 1075 A According To The Expectations Hypothesis, What Is The Market's Expectation Of The Oneyear Interest Rate Three Years From Now?

Stand What You Are Calculating That You Know Whether Your Calculator Assumes Course Hero

Zero Coupon Bond Value Calculator Calculate Price Yield To Maturity Imputed Interest For A Zero Coupon Bonds

It is not a good measure of return for those looking for capital gains Furthermore, the current yield is a useless statistic for zerocoupon bonds The Yield to Maturity, Part 1 Unlike the current yield, the yield to maturity (YTM) measures both current income and expected capital gains or lossesZero Coupon Bond Yield Formula (with Calculator) CODES (2 days ago) A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000

Valuing Bonds Lecture 6 Online Presentation

Zero Coupon Bond Value Calculator Find Formula Example More

Calculating Yield To Maturity Of A Zero Coupon Bond

Your Money Should You Invest In Zero Coupon Bonds The Financial Express

Print Pack And Ship With Fedex Office

/GettyImages-983195940-6d4c5099c3314718a5ba16c33205d071.jpg)

Calculating Yield To Maturity Of A Zero Coupon Bond

What Is A Zero Coupon Bond Who Should Invest Scripbox

Explain Why A Zero Coupon Bond Sells For Less Than A Coupon Bearing Bond Of Identical Maturity Quora

Chapter 4 Analysis Of Single Cash Flows

What Is Zero Coupon Bond Example

Zero Coupon Bond Calculator Yield To Maturity

Chapter 6 Bonds 6 1 Chapter Outline 6 1 Bond Terminology 6 2 Zero Coupon Bonds 6 3 Coupon Bonds 6 4 Why Bond Prices Change 6 5 Corporate Bonds Ppt Download

How To Calculate Bond Price In Excel

1

Bond Yield To Maturity Calculator Download Apk Free For Android Apktume Com

Zero Coupon Bond Calculator Calculator Academy

Bond Coupon Bond Yield Calculation And Valuation Finpricing

Zero Coupon Bond Definition Formula Examples Calculations

Q Tbn And9gcspuy9giugvfcvueflrzidtvhlsn9e5eqcnannn Rbj6l5qub Usqp Cau

Calculating And Using Implied Spot Zero Coupon Rates Bond Math

Q Tbn And9gcsino 0g4j4abcfdbc09bh1lusrg0 Zbznmqfuhlv Gyae8xqig Usqp Cau

Calculate Zero Coupon Bond Valuation Valuation Calculator

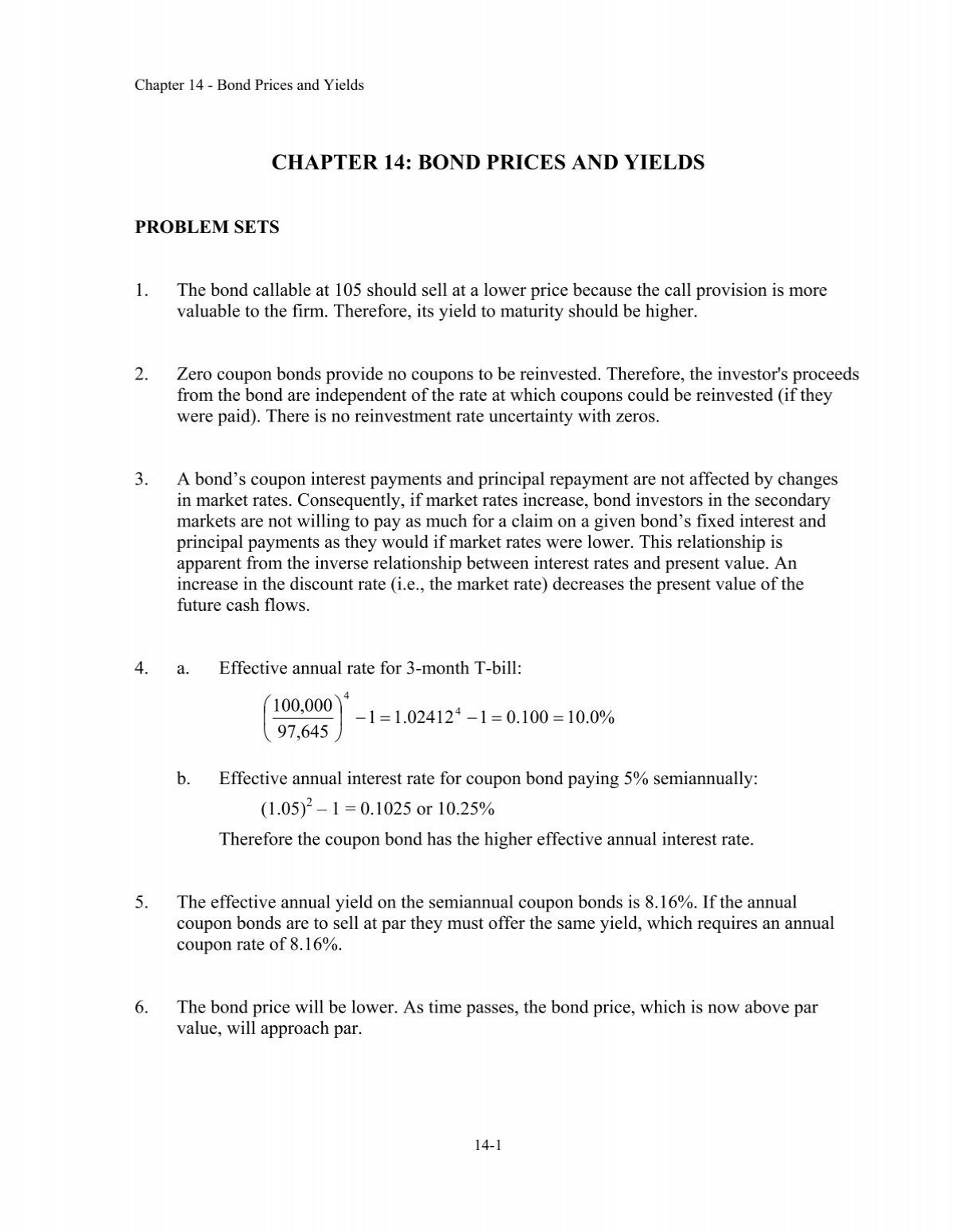

Chapter 14 Bond Prices And Yields To Maturity

2

Coupon Two Coupon Yield

How To Calculate Bond Price In Excel

How Do I Calculate Yield To Maturity Of A Zero Coupon Bond

Yield To Maturity Calculator Zero Coupon Bond

Valuing A Zero Coupon Bond Mastering Python For Finance Second Edition

Zero Coupon Bond Definition Formula Example Financial Accounting Class Video Study Com

Bond Valuation Phd

Bond Yield To Maturity Calculator For Comparing Bonds

Problem Set 1 Fins2624 Portfolio Management Studocu

Berk Chapter 8 Valuing Bonds

Solved Chapter 7 Problem Set Students Must Show Work To Receive Full Credit Compute The Price Of A 9 Coupon Bond With Years To Maturity And A Course Hero

Bond Yield To Call Ytc Calculator

Bond Formula How To Calculate A Bond Examples With Excel Template

Zero Coupon Bond Study Bonds Finance Yield Curve

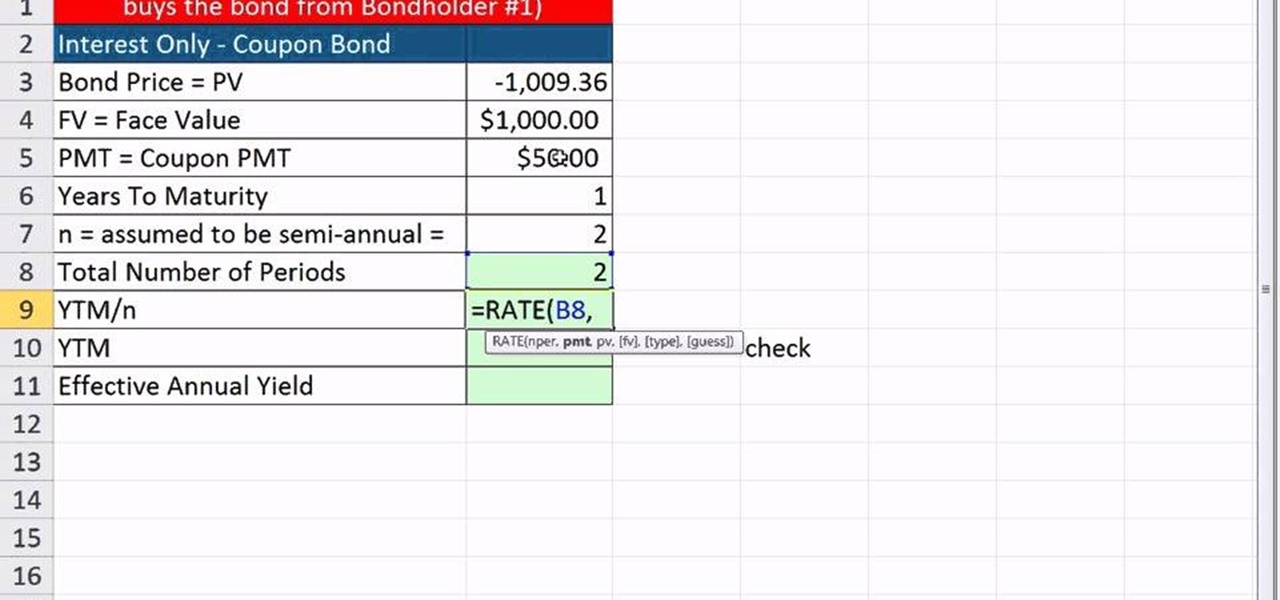

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

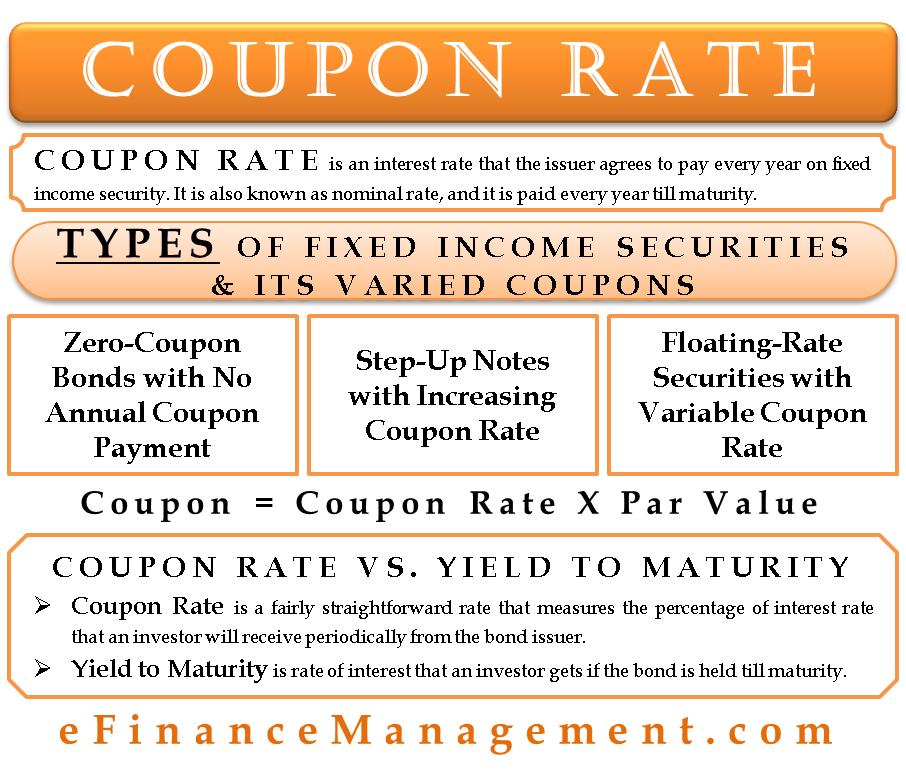

Coupon Rate Meaning Example Types Yield To Maturity Comparision

Calculate Zero Coupon Bond Valuation Valuation Calculator

Bond Valuation And Bond Yields P4 Advanced Financial Management Acca Qualification Students Acca Global

Zero Coupon Bond

Zero Coupon Bond Yield Calculator Find Formula Example More

Calculating The Yield Of A Zero Coupon Bond Youtube

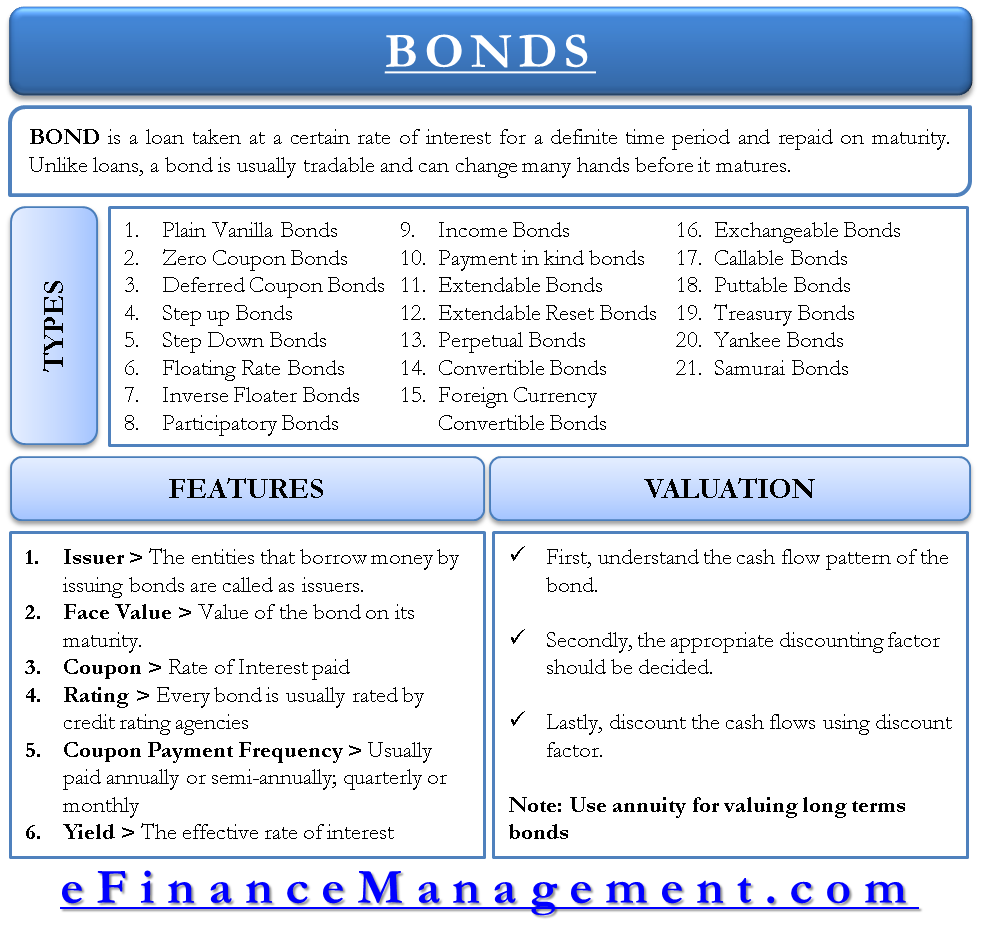

All The 21 Types Of Bonds General Features And Valuation Efm

Alexander Nunez Torres Phd Ppt Download

Mgt338 Chapter 6 Valuing Bonds Team Study

%201.jpg)

Bond Valuation

Http Burcuesmer Com Wp Content Uploads 15 10 Bond Valuation Pdf

What Is A Zero Coupon Bond Who Should Invest Scripbox

2

Bond Pricing And Accrued Interest Illustrated With Examples

Vba To Calculate Yield To Maturity Of A Bond

How To Calculate Pv Of A Different Bond Type With Excel

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

Chapter 10 Bond Prices And Yields Pdf Free Download

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Problem Set 1 Tutorial Question Studocu

Http Wpscms Pearsoncmg Com Wps Media Objects 9039 Studyguide Ema Ge Berk Cf 2ge Sg 08 Pdf

The Yield To Maturity On 1 Year Zero Coupon Bonds Is Currently 6 5 The Ytm On 2 Year Zeros Homeworklib

Bond Yield To Maturity Calculator Download Apk Free For Android Apktume Com

Bond Yield To Maturity Ytm Calculator

Http Www Cass City Ac Uk Data Assets Pdf File 0015 I 1 Pre Calc Pdf

16 2 Bond Value Personal Finance

Modified Duration

Fcondemand Fixed Income Investing

How To Calculate Yield To Maturity 9 Steps With Pictures

Solved Trader Purchased A 10 Year Zero Coupon Bond At A Y Chegg Com

The Zero Coupon Bond Pricing And Charactertistics

Zero Coupon Bond

Answered What Is The Value Of Zero Coupon Bond Bartleby

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Bond Yield To Maturity Ytm Calculator

コメント

コメントを投稿